Payroll Deduction

Payroll Deduction

You’re on the move all day, every day. So why should your money stay in one place?

Use CRCU’s payroll deduction service to put funds from your directly deposited paychecks exactly where you want it. Make loan payments or savings deposits without a second thought! Payroll deduction automatically sends a specified portion of your regular pay wherever you choose. It’s quick, convenient and absolutely free!- Distribute partial direct deposit funds to various accounts

- No fee

- Faster funds availability

- View your deposit through CRCU Online Banking or Mobile Banking

- Can be used for checking or savings accounts

- Provide your CRCU account number (MICR number) and CRCU routing number to your employer or payer to have them set up direct deposit service with CRCU

How to get it

To sign up for direct deposit, complete the form you receive from your employer or other payer with the following information:

- Your 14-digit CRCU account number (MICR)

- Our CRCU routing/transit (ABA Number): 313077513

- Our mailing address and phone number:

Community Resource Credit Union

P.O. Box 3181

Baytown, TX 77522-3181

(281) 422-3611 or (800) 238-3228

Or, you may also print and complete our DIRECT DEPOSIT FORM and give it to your employer.

CRCU's Routing Number: 313077513

What is an ABA Routing Number?

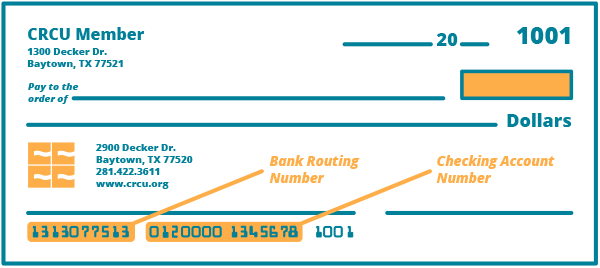

Find Your Account (MICR) Number on Your CRCU Checks

Checkbook & Checks

.png)

Automatic Transfers

Just in case Payroll Deduction doesn’t work for your situation, you can still schedule automatic transfers in our mobile banking app or through online banking!

- Scheduled Account Transfers

- Scheduled Loan Payments

- Scheduled Bill Pay Transactions

Need Assistance?

For personal help with setting up payroll deduction, drop by your neighborhood CRCU branch or give us a call at (800) 238-3228.

FAQs

Frequently Asked Questions

How can I find out if the direct deposit transaction was completed as directed?

View your account online through Online Banking or Mobile Banking. Contact CRCU for more information.

What is a MICR Number?

Magnetic Ink Character Recognition number that allows financial institutions to process checks and ACH. It is the same as your account number.

Where can I locate my share product MICR Number?

AccessOnline Banking or Mobile Banking, locate your share product, and select detail for the product information for each share.